Stage 3 Tax Cuts – Amended Legislation

The Federal Government has introduced its planned changes to the existing Stage 3 tax cuts into Parliament. Treasury Laws Amendment (Cost of Living Cuts) Bill 2024 will amend the existing legislation for the planned Stage 3 tax cuts due to commence this 1 July 2024 for individuals.

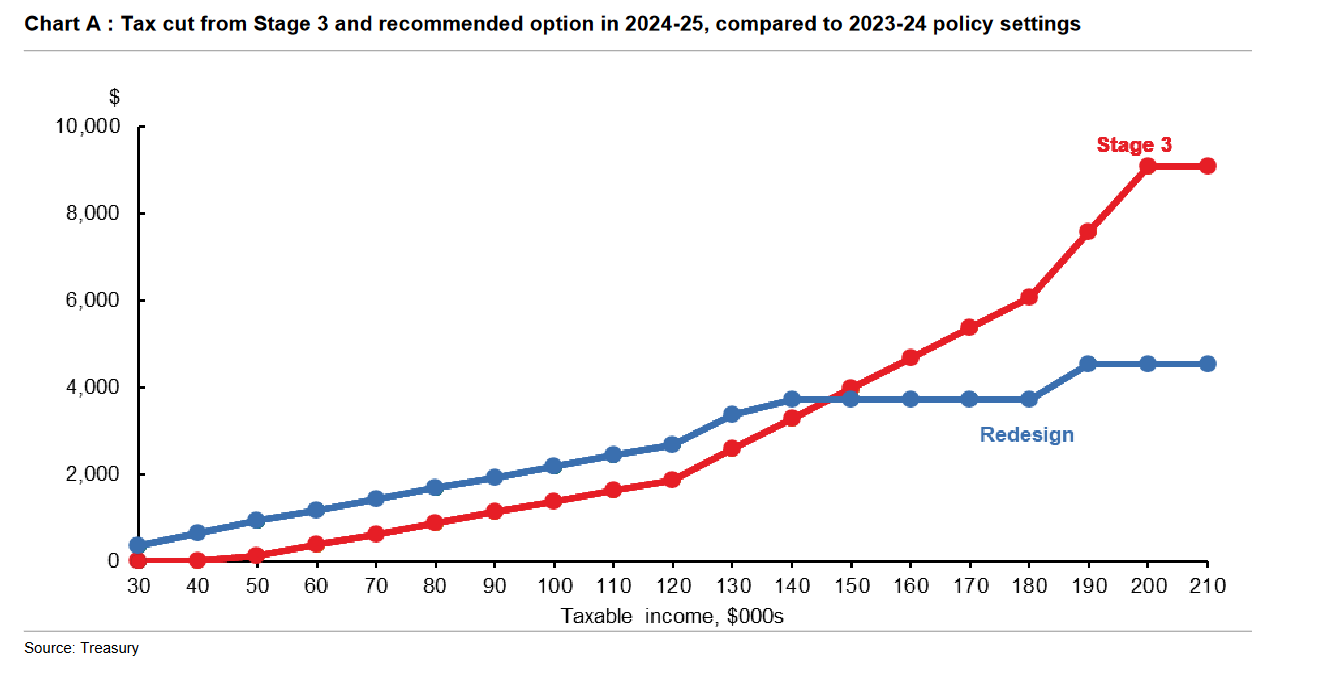

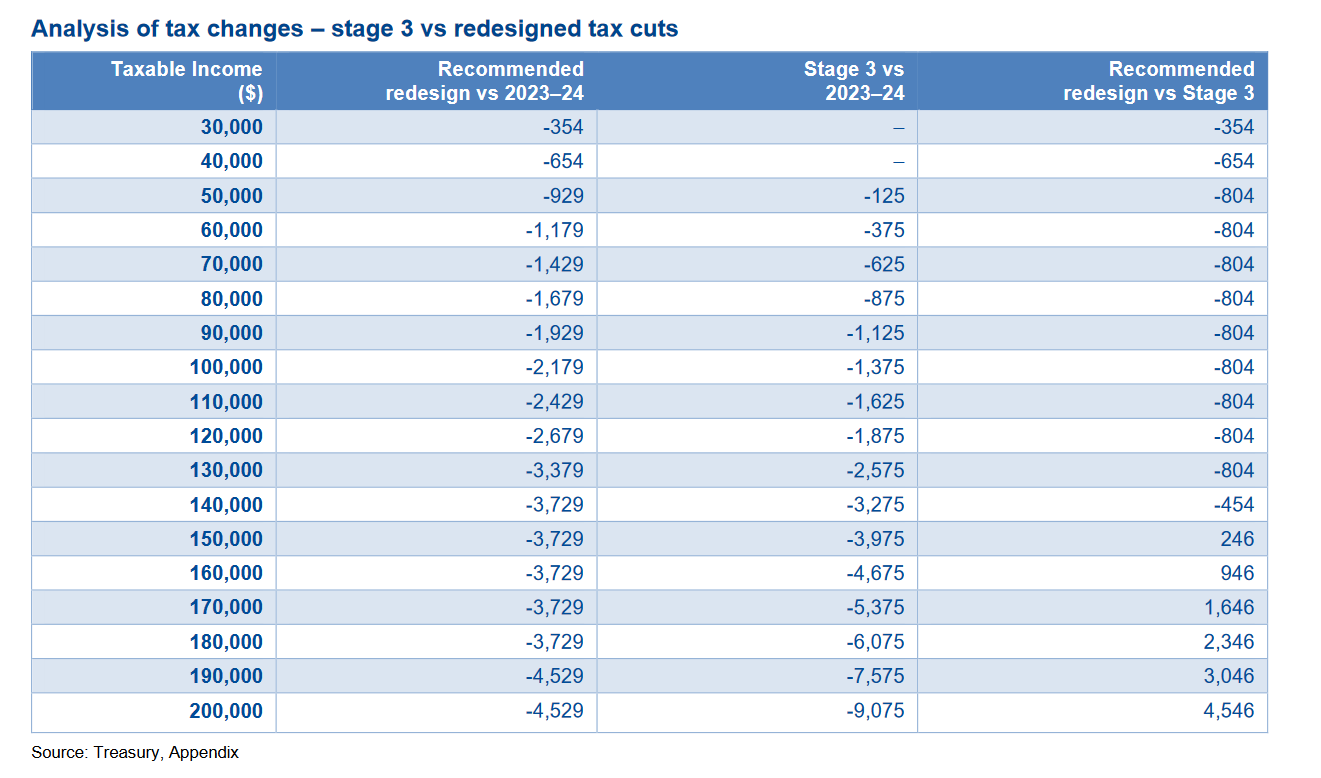

As reported by Treasury and the Federal Government, the proposed changes to Stage 3 tax cuts will provide broader relief to Australian households. Arguably, individuals who have taxable income below $146,000 approximately should receive a larger tax cut from the 2024/25 financial year than originally intended under the original Stage 3 cuts. Australians on the top marginal tax rate will still receive a tax cut but the amount will be greatly reduced.

It is important to point out that the intended Stage 3 cuts were part of an overall “7 Year Plan for Personal Income Tax Cuts” introduced in 2018 by the then Coalition Government to address future bracket creep. Stages 1 and 2 had already addressed the low to middle income thresholds as well as introducing higher income tax offsets. Stage 3 was the final step in this 3-pronged approach to address tax liability for the higher tax rates. It is acknowledged the plan had been developed before the increase in cost-of-living pressures now facing many Australians.

Existing Stage 3 Legislation

Under legislation as defined by the previous Coalition government’s Stage 3 tax cuts, the 37% tax rate would be removed and a new 30% tax rate would be introduced for taxable income between $45,000 and $200,000. Effectively, having 3 levels of marginal tax rates instead of 4.

Amended Legislation

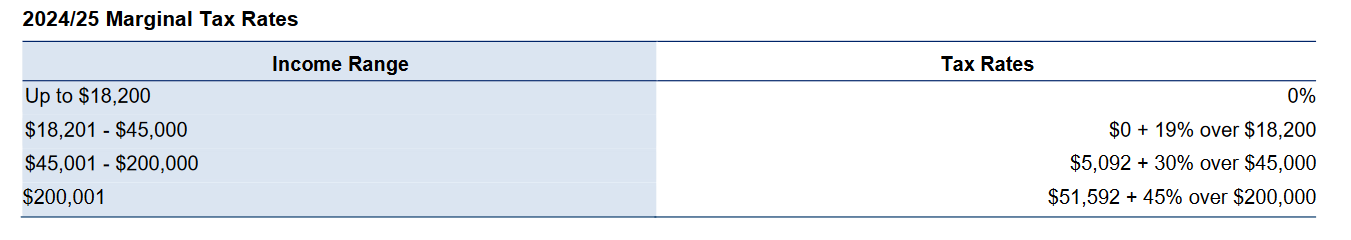

Labor’s proposed amendments retains 4 levels of marginal tax rate but with changes to the rates and thresholds. The 19% tax rate will reduce to 16%, the 32.5% tax rate will reduce to 30%, and the 37% tax rate will be retained. The $120,000 threshold will increase to $135,000 and the $180,000 threshold will increase to $190,000.

What it means for Australian taxpayers

In their paper, “Advice on amending tax cuts to deliver broader cost-of-living relief”, Treasury estimates all taxpayers will receive a reduction in their tax liability based on the amended Stage 3 proposal.

A taxpayer on $40,000 per annum taxable income will receive a tax cut of approximately $654 in contrast to receiving no tax under the existing plan. A person with taxable income of $100,000 should expect a tax cut of approximately $2,179, $804 more than the existing plan. Someone on $190,000 taxable income will receive approximately $4,500 as a tax cut, which is half of what would have been received under the existing plans.

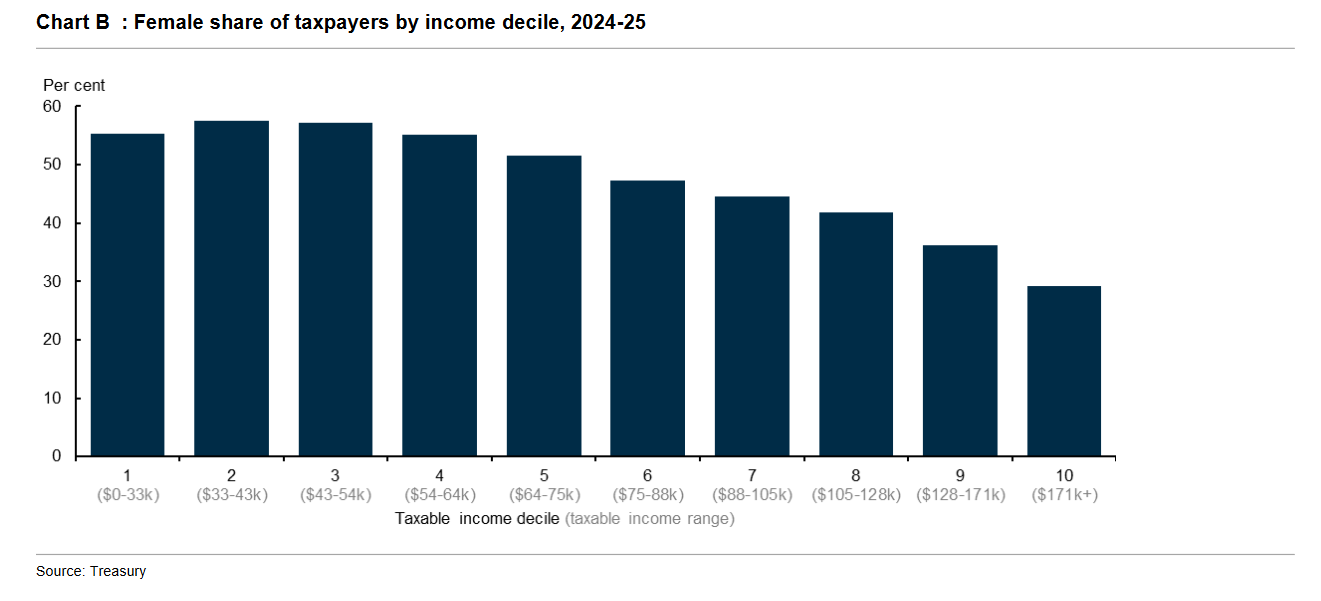

The paper argues the recommended redesign will provide greater benefits to individuals in the low-to-middle-income range, which has disproportionately more women than higher income rates (Chart B).

Addressing bracket creep

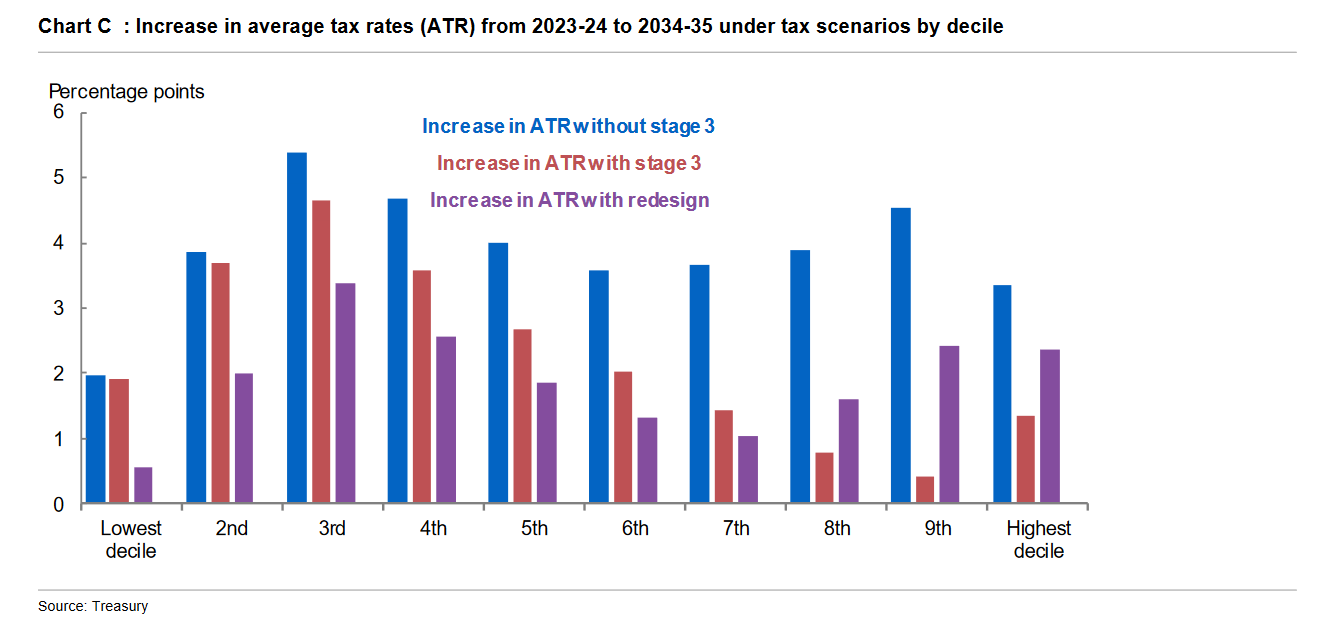

Based on their analysis, Treasury believe the revised Stage 3 cuts will help reduce bracket creep more for low to middle income taxpayers over the next 10 years. They argue the average tax rates for higher income earners will still significantly reduce compared to a no change in taxes scenario but by less than under Stage 3.

In Closing

One cannot argue the point that the intended Stage 3 tax cuts had been designed and legislated in different circumstances. The redesigned tax cuts will reach all Australians and not just those on incomes of $200,000 or more. Household cost-of-living pressure is significant, there is no doubt. It is for this reason the Treasury Bill will likely be supported by most parties and will likely pass in the Senate.

However, it remains to be seen what these changes will do to Australia’s “progressive tax reform” and indeed if Treasury has got it right in relation to moderating bracket creep and promoting productivity. Some economists argue the changes pose a risk to productivity and living standards. Opposition Leader, Peter Dutton MP, has announced he will reverse the changes if this risk eventuates, should his government be elected in the next Federal election.

Would a change to our GST system – of which many see as a more efficient tax than income tax - have been more effective?

Financial advisers and accountants will be exploring new opportunities for their clients to take advantage of the changes from 1 July this year. Strategies including salary sacrifice and tax-deductible expenses will be front of mind. Making additional contributions into super could be a worthwhile strategy for some, particularly when it is likely the concessional contribution rate of $27,500 will increase to $30,000 for the 2024-25 financial year.

A final word of caution. If the Federal Government is willing to break an election promise “for the greater good”, what other areas of taxation they had previously promised to leave alone will be re-examined? We wait and ponder.